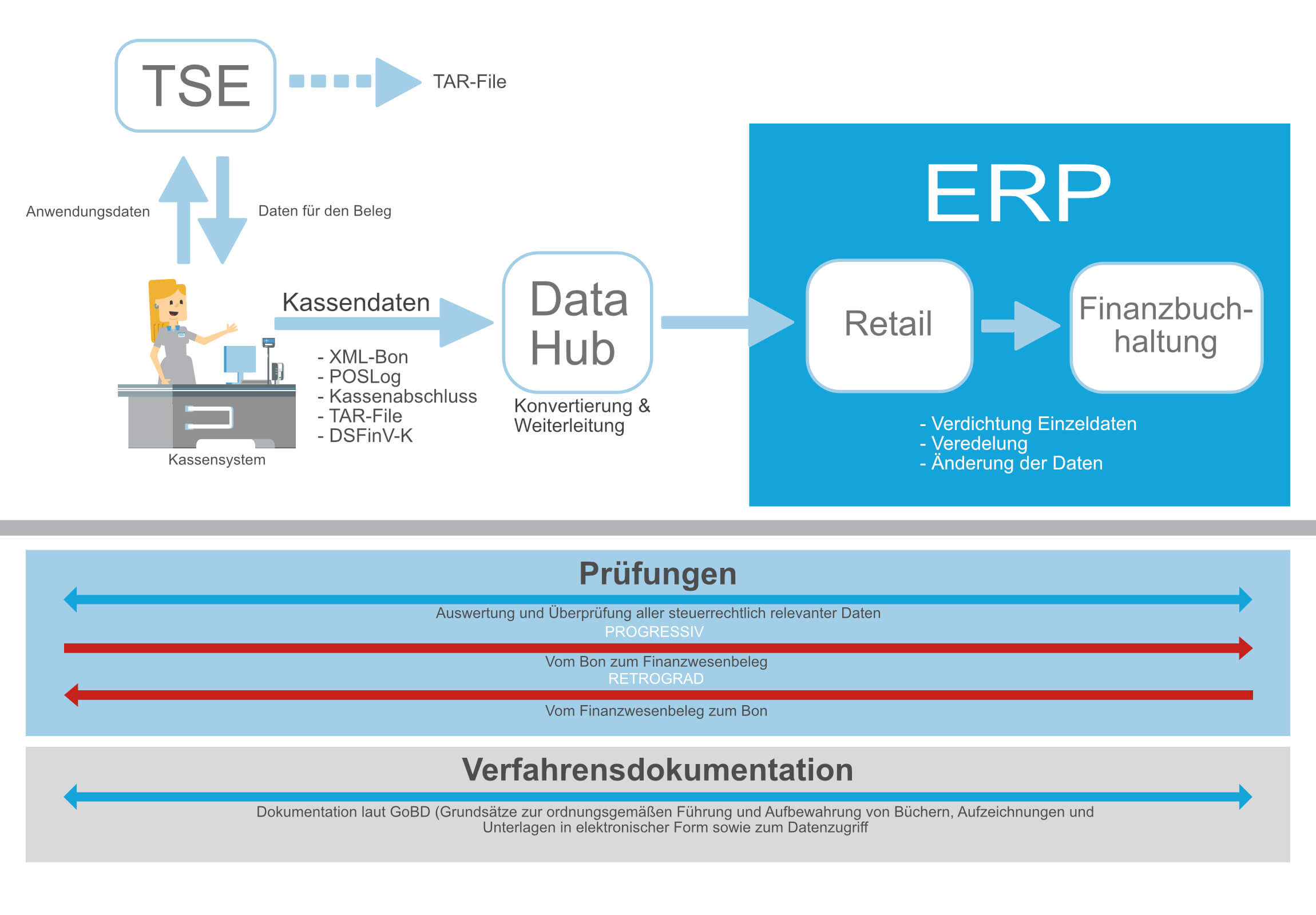

Integration of a Technical Safety Equipment (TSE) into an Electronic Recording System with SAP Interface

Fiscalization - the buzz word and hotly debated topic raises some questions in the area of electronic POS systems: How and what data do I have to store and manage in order to operate within a legally compliant framework as a retailer? What is the so-called "technical security device" all about? How do I protect the system from manipulation? What is meant by retrograde and progressive auditing?

With the enactment of the Cash Protection Ordinance on 26.9.2017 - KassenSichV for short - the legislator wants to ensure that digital records of purchase processes cannot be manipulated in view of the high complexity of IT structures. The immutability of transactions was already regulated in the GoBD prior to the enactment of the KassenSichV, but these are not a law but merely an administrative regulation.

The deadline for the practical implementation of the regulation ends on January 1, 2020. With approximately two million cash registers in Germany, it is already becoming apparent that retailers will not be able to meet this deadline. This has already been taken into account: the deadline has been extended to September 2020. This circumstance does not make the issue any less urgent, however, as both cash register providers and retailers are still undecided as to how the practical implementation of the new regulations is to proceed.

So what does the retail sector need to do now to implement the fiscalization of its own checkout systems? Are there any other fields of action or construction sites that should be dealt with at the same time?

In our free whitepaper you will find the most important information on fiscalization.