- All

- General

- Customer projects

- Trade fairs

- Online event

- Partner

- Software News

- Uncategorized

- Wiki

Wiki

Cash register inspection: Can audits be postponed?

The cash register inspection usually comes unannounced - and often at the worst possible time. But what happens if the business owner is not present or the ...

27 May 2025

General

Cash register reporting obligation from 2025: What retailers need to know now - and how good preparation saves time and nerves

The electronic cash register reporting obligation came into force in Germany on January 1, 2025. It obliges retailers to report their electronic Cash register systems at the Tax office to register - and ...

April 16, 2025

Customer projects

Success story: Efficiency and tax compliance at FRS KG

Digitalization does not stop at the shipping industry. FRS KG has used this change to optimize its processes on board. A central ...

January 13, 2025

General

Effective cash register monitoring - how to achieve tax compliance!

Among retail accountants, there are few topics that require as much attention as tax compliance. And this is exactly where a modern Cash register monitoring into ...

December 10, 2024

Software News

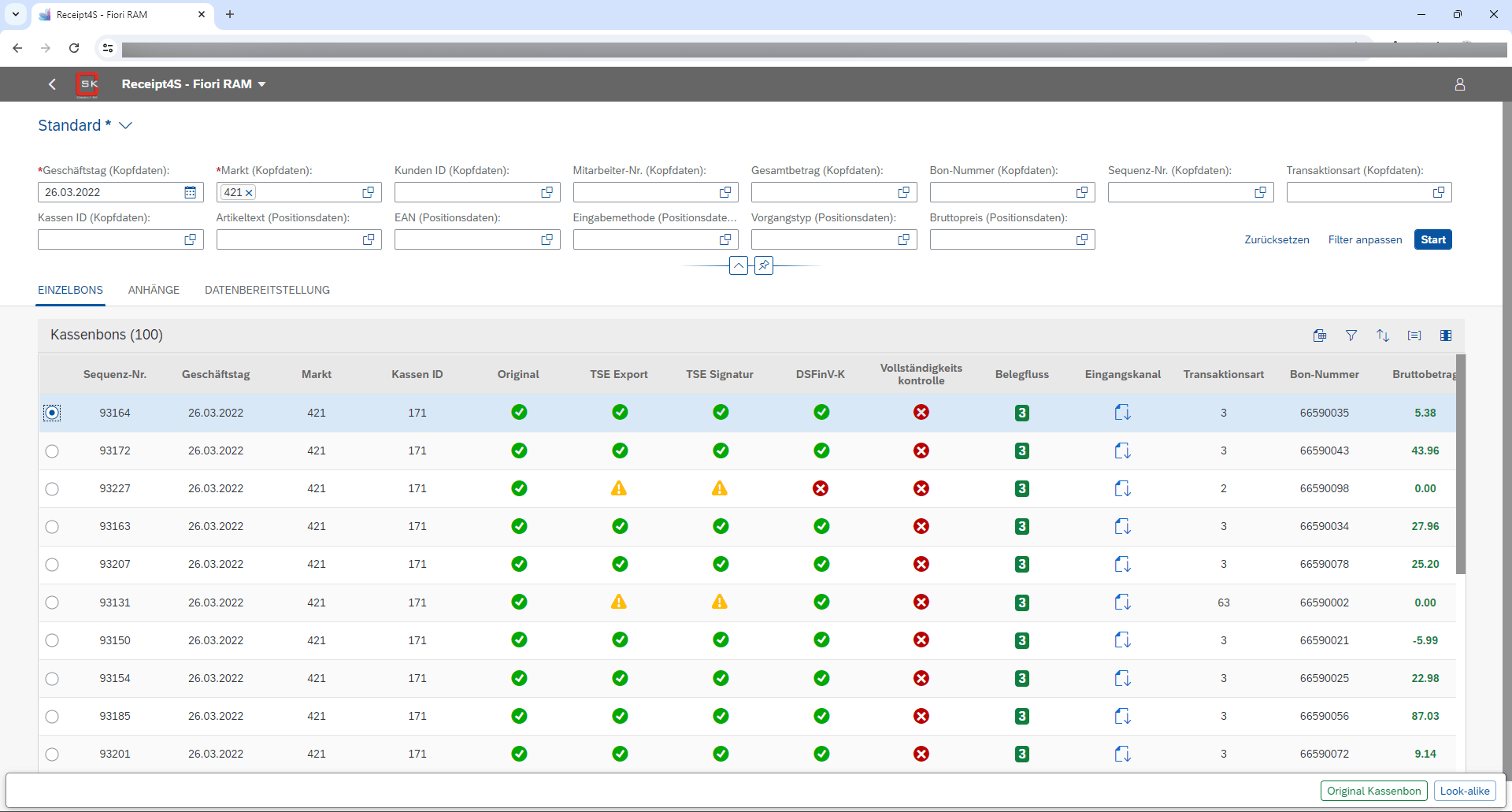

Discover Receipt4S® - now in the interactive Click Through Demo

What's better than listening to a lecture about benefits? Trying it out for yourself! That's why we've created a Click Through Demo for Receipt4S®. This interactive demo ...

August 5, 2024