Cash register reporting obligation from 2025: What retailers need to know now - and how good preparation saves time and nerves

Success story: Efficiency and tax compliance at FRS KG

Effective cash register monitoring - how to achieve tax compliance!

Tax compliance management

Are you prepared for an audit by the tax authorities?

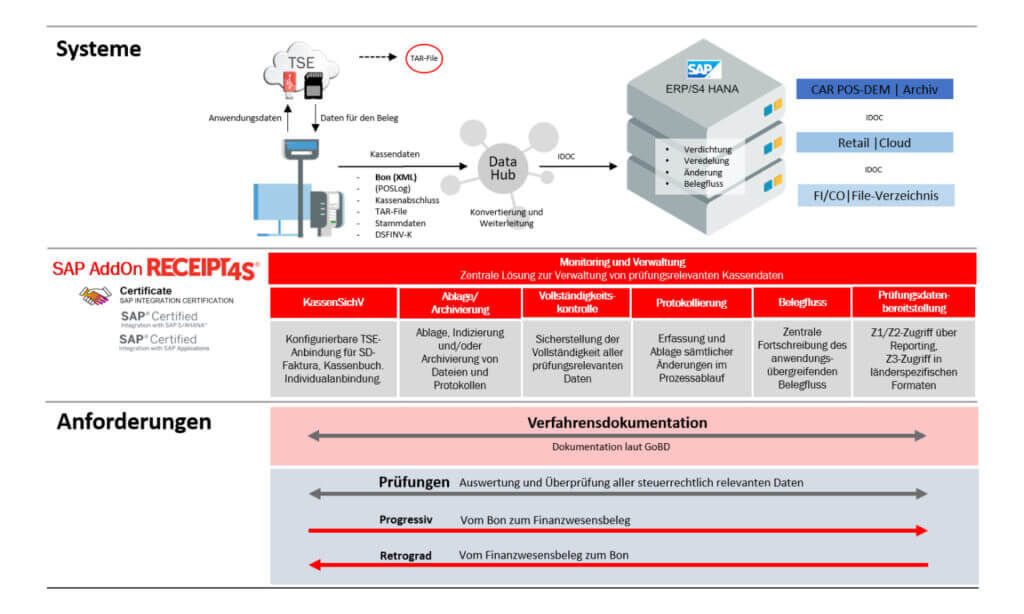

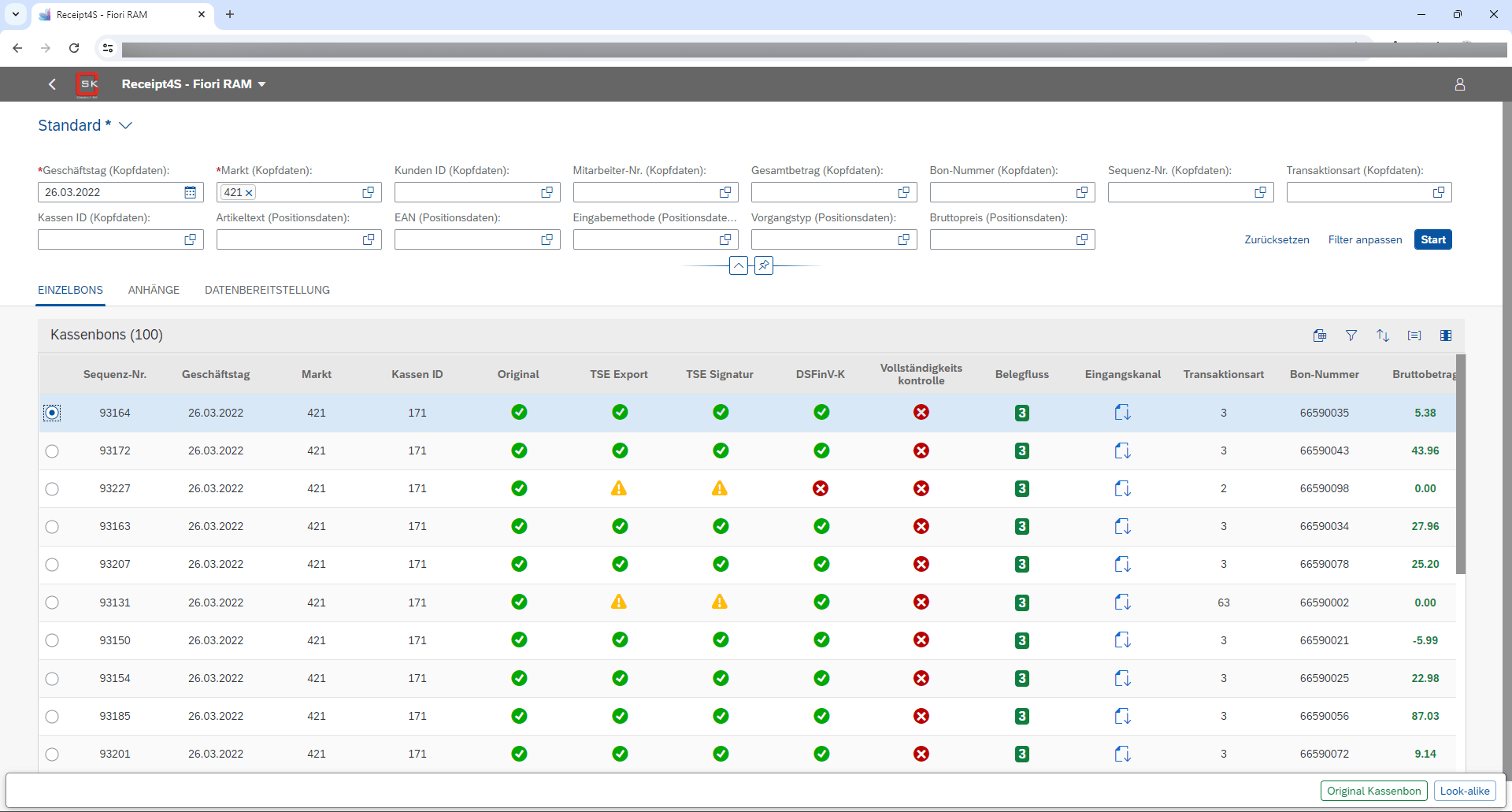

Receipt4S® is the uncomplicated way to avoid tax risks through Tax compliance! Thanks to the complete recording of all business transactions, including TSE signature/TAR files/DSFinV-K exports, you are prepared for any financial audit.

We would be happy to carry out a Exam simulation so that you can start working before a possible Cash register inspection know whether improvements need to be made to the recording and archiving of POS data.

WEBINAR RECORDING //

Cash audit: What the tax office wants to see now

with Tobias Teutemacher (Dipl. Finanzwirt (FH) and tax investigator) and Karl-Heinz Kühlkamp (Senior Account Manager Retail | d.velop AG

01.

Why choose Receipt4S®?

The KassenSichV and audits are coming! That's why we paid close attention to the legal requirements when developing Receipt4S® and took into account that the connection to the archive can be customized for each customer. Despite a high level of standardization, which contributes to a prompt go-live, our add-on provides the necessary flexibility.

Important: The document flow must be clearly traceable from the receipt to the FI document and vice versa. Keyword: process documentation! In addition, the receipt data offers various monitoring options that are of interest to retailers in controlling.

02.

SAP certification

Our AddOn is officially approved by SAP® certified (on-premise and for the cloud) and can be integrated into SAP® ERP, S/4 and CAR systems as standard. The innovative solution has withstood detailed testing by experts and meets all the information technology and business requirements of the SAP® community.

The customer confidence that comes with this seal of approval will become even more important in the area of POS systems in the future, because: Since January 1, 2020, the German Cash Register Security Ordinance (KassenSichV) requires electronic receipt output and a certified, three-part Technical safety device (TSE) mandatory!

03.

Satisfied customers

CSK combines innovative SAP technology with many years of process experience. The result: user-friendly, SAP-integrated software solutions for processing numerous document types in the areas of procurement, finance and sales.

Receipt4S® is used by numerous well-known retailers/trade groups and waste disposal companies. These include tegut..., Ernsting's family, DOHLE, Porta... and well-known discounters.

If you would like to find out more, take a look at our Success Stories.

KassenSichV mastered!

Over 20 million receipts archived in an audit-proof manner

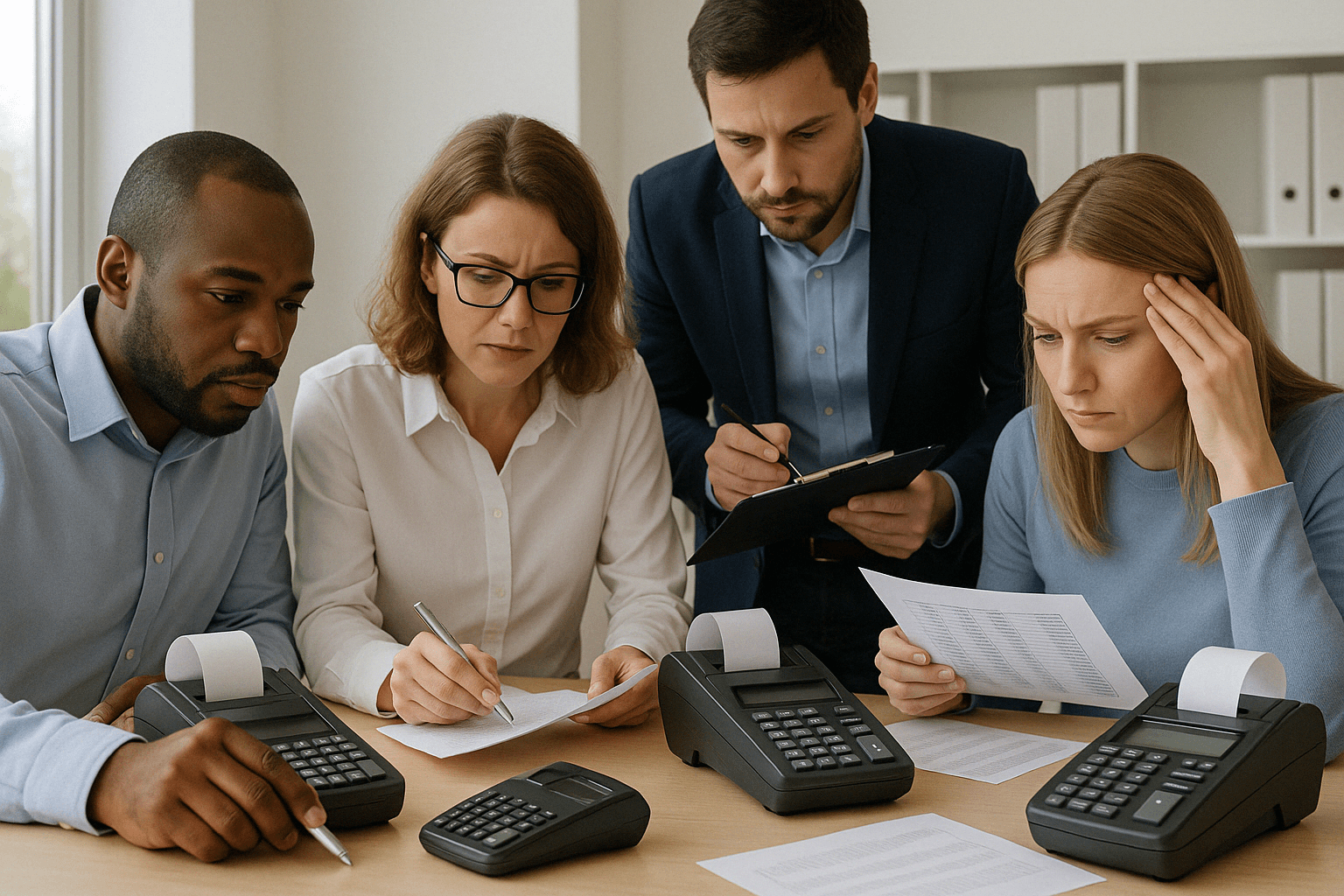

In a large retail company, sales receipts in the single-digit billion range can quickly accumulate in a year. These huge amounts of information must be kept in compliance with the law.

The first retail companies have had their receipt data verified by AmadeusVerify through the Tax office already behind them. No need to worry for our SAP® customers, because with Receipt4S® we ensure that data can be retrieved quickly and completely. We archive over 20 million receipts every day - audit-proof and traceable, including TSE signature and DSFinV-K Files.

Have you already dealt with the digital audit trail and can you provide all the necessary data?

Fact is...

In your company, you need a solution to manage all the data and requirements around the checkout process, audit them and ensure their completeness.

Stephan Kaup

Managing Director, Consult-SK GmbH

The doctor has time for you now

If you have any questions: Simply arrange a consultation with Dr. POS!

Problem-free integration (without TSE) of your existing cash registers incl. software

Transfer and GoBD/KassenSichV-compliant management of audit-relevant cash register data

Automated completeness control

Provision of audit data for Z1, Z2 and Z3 access (e.g. DSFinV-K, SAF-T export)

Progressive and retrograde audit tools SAP FI/CO and SAP CAR

UI5 web interface and reporting features

Kassensichv quiz

Beginner or professional?

Are you well informed about the topic? Find out with our little quiz! As a relief you will find in the whitepaper "Get on the safe side: Manage cash and fiscal data in SAP® in a legally compliant manner starting now"of our partner d.velop the concentrated KassenSichV knowledge in summary.

We are part of the RetailOneSolution Network - an alliance of three SAP partners who complement each other ideally in terms of technology and strategy in order to jointly offer THE ONE solution for handling sales and merchandise management data.

hokona is a specialist for the flexible cash register solution from SAP!

With its omni-channel solution, CAS ensures convenient store merchandise management at every touchpoint!

With our add-on, you can archive, audit and manage your Cash register data - KassenSichV-compliant & audit-proof!