Discover Receipt4S® - now in the interactive Click Through Demo

What's better than listening to a lecture about benefits? Trying it out for yourself! That's why we've created a click through demo for Receipt4S®. This interactive demo allows you to experience the features and benefits of Receipt4S® first hand and understand why it should be an essential part of your internal control system for tax compliance. What [...]

Audit simulation: Fiscal data correctly archived?

At the latest when a visit from the tax authorities is on the horizon, things start to get restless with regard to the archiving of cash register data. In our experience, the integration of a Technical Security Device (TSE) is old hat, but only a few retailers and wholesalers have actually simulated an audit to find out whether their archived individual cash register transactions are complete and correct with [...].

Tax compliance management: a safe bet with Receipt4S® in SAP

Every company is obliged to comply with statutory tax regulations. In retail, these regulations include GoBD as well as KassenSichV including DSFinV-K guidelines. Tracking whether these requirements are met is the task of tax compliance and includes the obligation to calculate and pay taxes correctly and finally submit a proper tax return. We help SAP users with this - with our unique [...]

Receipt4S: Your safety net in the era of AmadeusVerify

In the ever-changing landscape of financial audits, it's more crucial than ever for businesses to stay up to date with compliance requirements. Since April 2021, AmadeusVerify has established itself as the financial authorities' preferred tool for verifying cash register and TSE data. For SAP users wondering how to survive in this new era [...]

Quality assurance through certification: Receipt4S v2.0 for SAP S/4HANA Cloud

Consult-SK GmbH is pleased to announce the successful certification of the SAP AddOn Receipt4S v2.0. This certification was carried out in the SAP test system SAP S/4HANA Cloud, private edition, release 2022. The certification by SAP is proof of the quality and compatibility of our add-on, which ultimately contributes to the optimization of our customers' business processes. An important [...]

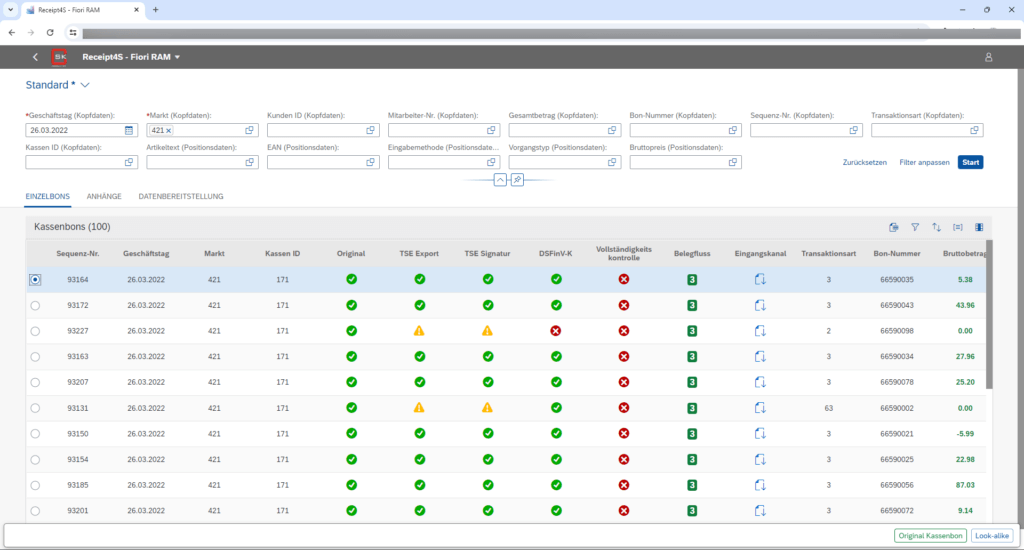

Receipt4S® Fiori App: Presentation and advantages

SAP Fiori enables the design of appealing interfaces and increases user-friendliness. In the following video, our Fiori expert Olga Becker explains to Managing Director Stephan Kaup why this technology offers numerous advantages in conjunction with our Receipt4S® add-on. https://receipt4s.de/wp-content/uploads/2023/04/Receitp4S-Fiori-App.m4v Advantages at a glance Location and device-independent retrieval of POS data Fiori interface is visually appealing and [...]

DSFinV-K and TSE exports: Why mistakes are made here

Since October 2020, retailers have been obliged to implement the KassenSichV. From the beginning of 2023, this will also apply to those who have made use of an extension of the deadline to convert their cash register and archiving system. In our HealthCheck workshops, however, we often find that retailers are still not sufficiently prepared for the audit. In this video [...]

KassenSichV mastered: Over 20 million receipts archived in an audit-proof manner

The first trading companies have already had their receipt data checked by the tax authorities using AmadeusVerify. No need to worry for our SAP® customers, because with Receipt4S® we ensure that data can be retrieved quickly and completely. We archive over 20 million receipts every day - audit-proof and traceable, including TSE signature and DSFinV-K files. Why do we need an additional [...]

Receipt4S® plus Cloud Archive: Our Partnership with d.velop

Anyone who correctly implements the KassenSichV guidelines quickly realizes: There is a huge amount of data that needs to be archived. So that this does not become a hardware construction site for our customers, you can combine our SAP® AddOn Receipt4S® with the cloud storage of d.velop. We like this partnership so much that we have adapted our explanatory video. So short and [...]