10 billion euros are lost to the German treasury every year due to missing entries, incorrect software and manipulated cash registers. The Cash Register Security Ordinance (KassenSichV), which came into force on January 1, 2020, is intended to put a stop to this, but many companies are failing to implement it. Christian Knell and Stephan Kaup explain why this is the case and what the reasons are.

"In principle, it's quite simple," says Stephan Kaup. "Because companies' records have been deficient in the past, they equip cash registers with a technical security device that protects against manipulation. In addition, an interface is set up that allows tax authorities to evaluate the data," explains the digitization specialist for invoicing processes from the company Consult-SK.

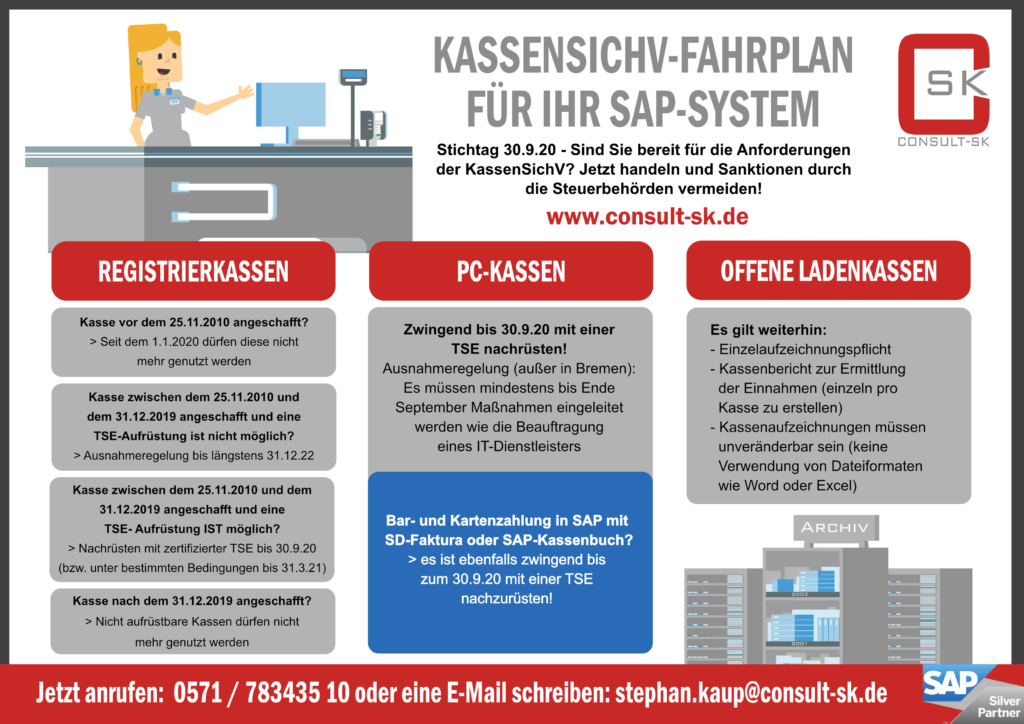

The legal basis for the scenario described is the German Cash Register Security Ordinance, which has been in effect in Germany since the beginning of the year. It stipulates that cash registers must be able to issue receipts, store all transactions in an unchangeable log and make this data available to the tax authorities via a digital interface (DSFinV-K). The cash registers must be registered with the tax office and must connect certified security devices (TSE) that ensure that every cash transaction is provided with a signature.

However, the implementation of the required anti-tampering standards demands a lot from companies. "Our customers have experienced that the cash duty is handled differently and partly uncoordinated by the federal and state governments," explains Stephan Kaup. For example, the receipt issue requirement has been in effect since January 1. The disregard was not sanctioned however, some Lands of the Federal Republic extended the period also summarily. Apart from divergent dates and missing sanctions above all the fact disturbs that the certification of the TSEs prescribed starting from 30 September cannot be accomplished so far at all. The consequence? Under certain conditions, the deadlines will be extended again - until March 30, 2021. Not surprisingly, this deadline extension is also not handled in the same way in all federal states.

However, the implementation of the required anti-tampering standards demands a lot from companies. "Our customers have experienced that the cash duty is handled differently and partly uncoordinated by the federal and state governments," explains Stephan Kaup. For example, the receipt issue requirement has been in effect since January 1. The disregard was not sanctioned however, some Lands of the Federal Republic extended the period also summarily. Apart from divergent dates and missing sanctions above all the fact disturbs that the certification of the TSEs prescribed starting from 30 September cannot be accomplished so far at all. The consequence? Under certain conditions, the deadlines will be extended again - until March 30, 2021. Not surprisingly, this deadline extension is also not handled in the same way in all federal states.

"This is very reminiscent of the introduction of the cash register in Austria three years ago," says snap managing director Christian Knell. "There, too, there were ambiguities and big question marks in the interpretation of the organizational and technical framework until the very end." Because in Austria, too, there was a long period of puzzlement as to who exactly the cash register obligation would affect at all.

"Some of our customers were very surprised at what ultimately turned out to be a "cash process" and the concrete impact that had on processes in SAP," says Christian Knell. "We're talking about classic FI postings, the cash ledger (the FBCJ, FPCJ, or FPCD), and a lot of distribution (SD (Sales & Distribution) - sometimes other exotics are added."

SAP is exercising restraint on this issue. The manufacturer leaves implementation to the companies and still does not offer a standard solution (as of the end of September 2020).

Not a last-minute issue

Precisely because there are still plenty of unanswered questions, companies should deal with the cash register requirement in good time. "The introduction is a project in which every company must find its own way. Accordingly, it must be organized and managed," says Christian Knell. Stephan Kaup confirms that interest in the topic is now also high in Germany: "The demand for specific offers has increased fivefold within the last six months".

Kaup, who, with his company Consult-SK, has been responsible for numerous well-known textile, food and furniture retailers in Germany, such as TegutPorta Möbel and Ernstings Family, tried to raise awareness among its customers at an early stage. The reactions were ambivalent.

"Some companies have actively faced up to the consequences of the Cash Security Ordinance, reviewed all relevant processes and made adjustments where necessary. Some seem to rely on unfortunately non-existent out-of-the-box solutions and others seem to think that the issue does not affect them. However, as the topic becomes more prominent in the media, we are finding that this attitude can change very quickly."

Here, too, Christian Knell sees parallels with Austria: "Our experience has shown that plug-and-play simply doesn't work because companies working with SAP in particular have very different process maps, modules and industry solutions in use." The good news: "Thanks to the implementation that has already taken place in Austria, concrete empirical values are available. It doesn't matter whether a customer has an in-house development, the SAP SD cash sales process, only FI, a cash book. a more "exotic" module or a special industry solution in use," explains the long-standing SAP partner.

Legally compliant and proven in practice

"In order to provide our customers in Germany with the best possible support, Consult-SK and snap have formed a consortium," explain Christian Knell and Stephan Kaup. This combines the best of two worlds: extensive know-how about the processes and requirements of retail in the German market on the one hand, and practically proven knowledge about the introduction and implementation of the cash register obligation in the SAP environment on the other. "The field-proven add-on developed by snap establishes the technical basis for the extension, logging, and document generation via ABAP. We realize the integration of the required technical security equipment (TSE) in the standard, for example, with the cloud TSE of the fiscalization specialist Fiskaly", says Christian Knell.

"Initially, it was just a matter of archiving all our customers' data relating to the checkout process. This often involved only ten, but sometimes thousands of points of sale - including the receipt, the cash register statement and, of course, the signature. In the meantime, however, it has also become a matter of documenting the entire process - from the cash register to the posting in financial accounting. Currently, the focus is on fiscalization, and the obligations from GDPdU and GoBD, which have been in effect for years, are often forgotten or suppressed," explains Knell. Potential sources of error that are prevented thanks to the collaboration between snap and Consult-SK, says Stephan Kaup, because "through the connection of our solutions we help to keep and manage data in compliance with the law. And in doing so, we fulfill all verification requirements - even across system boundaries."

Large retailers are able to meet the requirements of the German Cash Register Security Ordinance by using cash register software solutions. But sometimes this is not enough, because cash books are also kept that are not linked. Subsequently linking these to the SAP merchandise management system requires considerable additional effort and incurs extra costs. With the solution developed by snap and Consult-SK, companies can completely fulfill their verification obligations thanks to the integrated traffic light system and overview cockpit.

"In addition, our solution is the only one capable of actually and immediately showing requested receipts when requested by a financial auditor," Christian Knell and Stephan Kaup emphasize another asset of their solution.

With the right partner it works

Despite all the ambiguities and inadequate specifications - and even if the deadline for implementation is extended: the Cash Security Ordinance is a legal reality and must be implemented by companies. Time is short, yes. But with the appropriate planning, the right solution and the support of technically competent partners with practical experience - such as the consortium of snap Consulting and Consult-SK - a professional, legally compliant and fully integrated implementation is feasible.

Any questions? Gladly! You can reach our managing director Stephan Kaup by e-mail at [email protected] and by phone at +49 571 78343510.

We also cordially invite you to our webcast "Checkout data archiving like a boss" with our customer Tegut on October 28, 2020! For more information and the link to register for free, please visit here.